Sustainable Finance

Your Bridge

To a Sustainable Future

AEC Capital is a financial services firm focusing on Sustainable Financing, Investment Management, Capital Raising and Real Estate in Asia Pacific area.

Green Capital Drives Sustainability Development

Superior Return to Responsible Investors

Our Services

Money Lending

- Mortgage backed financing

- Credit fund

- Refinancing service

- Top Up & Cash Out Financing

- Total financial solution

- End-user Finance

Corporate Services

- SPAC set up

- LPF set up

- Company accounting and secretary services

- Company Set up

- Internal Audit

- Audit Tax

- Valuation

Real Estate

- Real Estates Transaction for Institution, HNW and Retail Clients

- Real Estates Fund

Our Capabilities

Equity Capital Market Opportunity

With many businesses turning to private credit for funding, investors have an opportunity to lend to companies at a high yield. Many infrastructure projects, particularly in the energy space, are financed through long-term contracts.

Debt Capital Market Funding & Opportunity

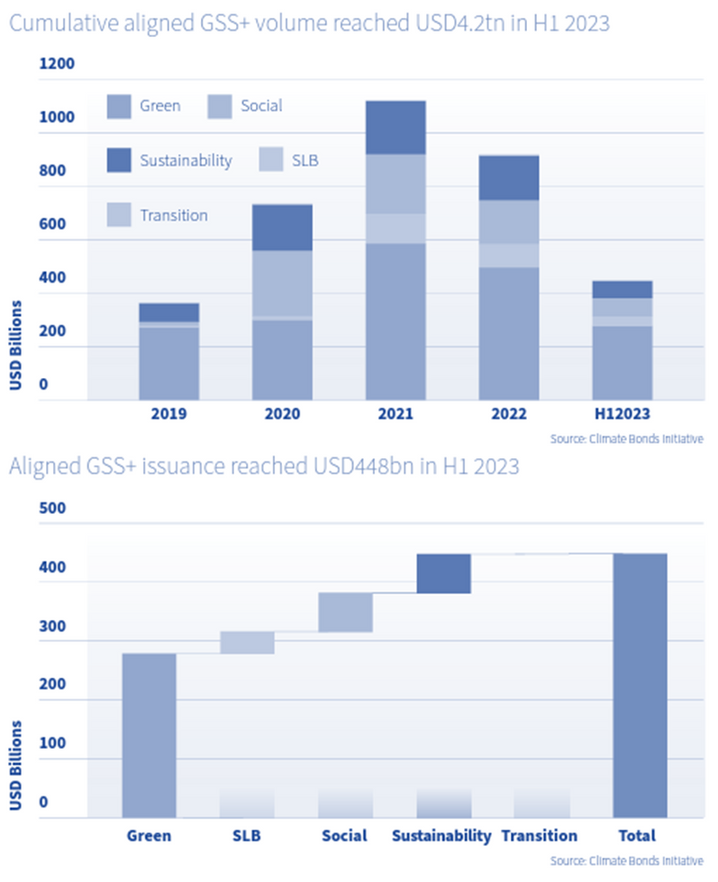

By the end of the first half of 2023 (H1 2023), the Climate Bonds Initiative (Climate Bonds) had recorded a cumulative volume of USD4.2tn of green, social, sustainability, transition, and sustainability-linked (GSS+) debt in alignment with its screening methodologies (aligned).

GSS+ bonds raised for environmentally beneficial activities, we saw more than $448 billion in issuance in 1H 2023.

Private Sustainability Finance

Companies and investors are increasingly working together to address critical global challenges. The adoption of environmental, social, and governance (ESG) considerations in private investments is evolving from a risk management practice to a driver of innovation and new opportunities that create long-term value for business and society. Promoting ESG adoption throughout the investment value chain can encourage greater private investment in sustainable development, resulting in greater impact.

Our Experts

John

LAM

Chairman

Rebecca SHUM

Managing Partner

Grace KWOK

Chief Sustainability Strategist

K.H.

YU

Senior Advisor

Dennis

WU

Founder & CEO

Clive

SZETO

Senior Advisor

Dr. Alex

LAU

Senior Technical Advisor, Chair Professor of Environmental and Sustainability, HKUST

Dr. K.W. CHAU

Senior Technical Advisor, Chair Professor of Real Estate and Construction

Let's work together

Address

Phone

Website

27/F, Overseas Trust Bank Building, 160 Gloucester Road, Wan Chai, Hong Kong

+852 2815 7028

dw@aechk.com

aec-capital.asia